Will There Be Stagflation In 2022?

Date of publishing: 05.03.2022

Executive Summary

- The Fed has moved swiftly in response to the onset of the COVID-19 pandemic – how will it follow up?

- With unprecedented measures and transitory rhetoric the market has shifted towards new expectations for 2022 with several rate hikes priced in

- Our view is that the Fed might commit a policy mistake by hiking too much and unwind the gains made during the economic recovery of the pandemic

- We are slightly positive on equities as our stagflationary outlook would benefit tech. The bond bull market is long not over.

Introduction

How the economic data has evolved thus far

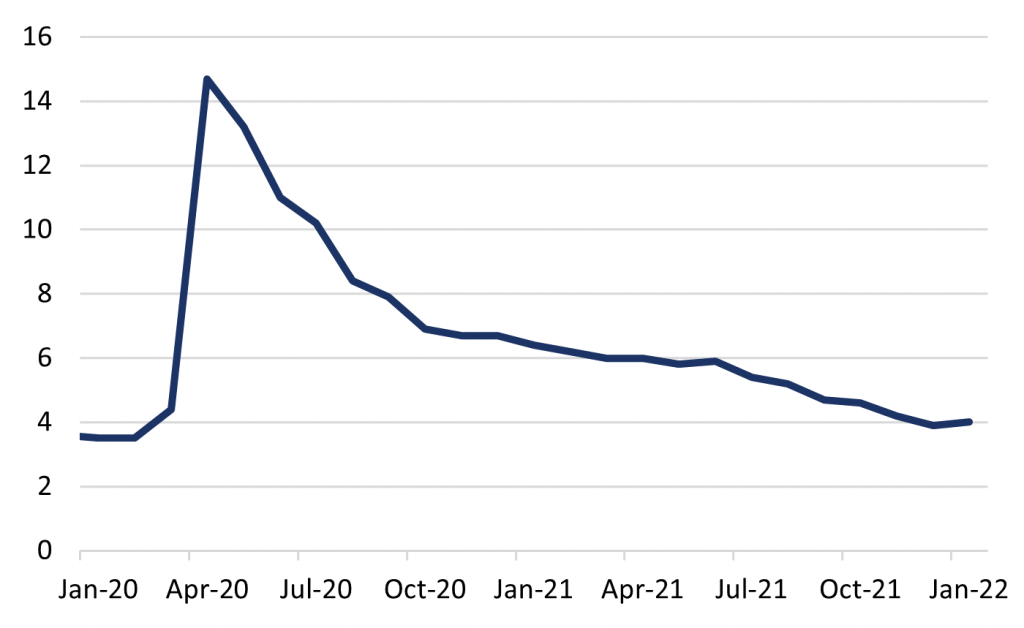

Unemployment Rate (in %)

The negative side effect of a stimulated economy is an increase in inflation that deviates from the target rate of the central bank and thus not aligned with the long term goals of a stable economy. Over the time period from 2021 to the beginning of 2022, we saw a rapid increase in the level of the consumer price index that spiked in January 2022 to 7.5% YoY. Additionally, the low level of the Manufacturing PMI at 55.5 and a Services PMI of 51.2 are worrisome as they are the lowest since March 2021.

Quantitative easing and the low-interest rate policy of the Fed helped to keep the economy afloat, though the combination of the energy crisis and supply bottlenecks resulted in a spike in inflation and a slowdown in manufacturing and services activity that caused worries and uncertainty on US equity markets.

Looking at adjusted price changes over the period between February 2021 and February 2022, we have had an increase in consumer prices not seen since the 80s. Inflation was driven by factors such as energy; this was caused by an imbalance between global oil and gas supply and the demand side which led to a sharp price rally over the recent year. Additionally, vehicles witnessed strong price inflation as well as used vehicles. The reason is that after the pandemic-induced shutdowns of car manufacturing plants the demanded amount was not supplied to the global markets. This ties together with supply chain disruptions for microchips and other necessary technological components that caused synthetic price inflation for new vehicles. Prices climbed rapidly by 40.5% over the time span of a year.

Are the US the possibly victim of imported inflation from Asia? It becomes clear that imported goods rose by 11.7%, nonetheless if we take oil out of the equation the price level of imports increased only by 0.5%. This instance implies that imports have a strong effect on inflation for the US, but it is more so caused by the above-described supply-chain disruption which feeds into several industries – very prominently in the commodity market.Moreover, a spike in private savings from 2020 onwards added to the stimulus of the Fed channeled more potential money and built-up spending to a slowly overheating economy. In 2020 and 2021 the private savings rate was 16.3% and 11.9%, respectively. The increase in the savings rate was also a clear indicator of the uncertainty of the future that consumers and private households were facing.

What the market is pricing in today for 2022 and beyond

How we see things differently

The problem with the Fed’s intended actions is that monetary policy works with a lag since the transmission mechanism of increasing the fed funds target rate takes time to trickle through to end consumers. One sensible reason for committing to rate hikes is that it wants to adjust inflation expectations. But do we need possibly seven rate hikes to achieve that adjustment? Inflation expectations based on the 5y5y forward inflation rate are hovering at 2%, the Fed’s medium to long term inflation target. This indicator was at its highest in mid-October 2021 at roughly 2.4%.

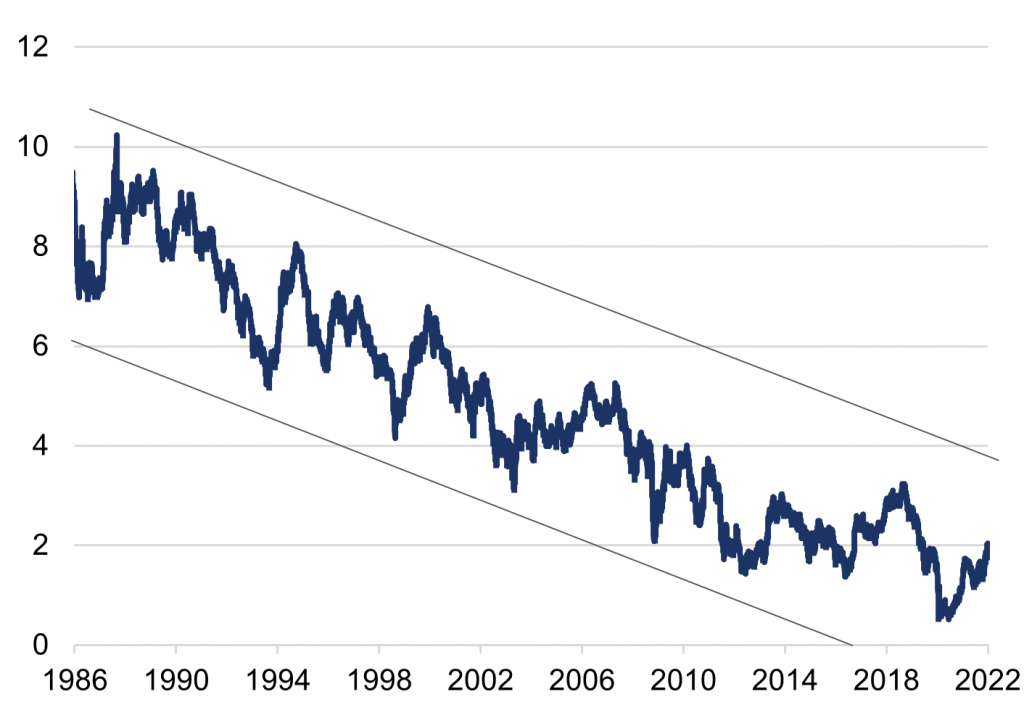

So was the market ever expecting the Fed to lose control over consumer prices and gravitate towards a higher interest rate environment? The structural problems in the developed world will long persist, and the inflation shock fueled by supply constraints and the commodity price rampage will cool off eventually. So the big question is: Will the Fed actually follow through with seven rate hikes? Taking the above into account, the Fed could be hiking into a slowdown of the economy and reverse its rate-hiking soon afterwards, as implied by market-based rates expectations.2Y1Y – 1Y1Y OIS (in %)

Considering the lag of the transmission mechanism, the Fed could have started hiking a few months earlier and may have averted some of the price increases that have resulted from elevated demand after the reopening of the economy. Now it seems that the Fed has made a policy mistake, making this tightening cycle perhaps shorter than anticipated.

Getting back to the question of seven rate hikes, that seems rather unlikely in our view, given the prospective outcomes lying ahead, which would drive the economy into a recession and unwind some of the labor market gains that have been made. It is a difficult balancing act for the Fed trying to get inflation and a tight labor market under control, though it emphasized employment numbers to be of higher priority up until now. If the Fed follows through on seven rate hikes, it will do so during the peak of the economic upturn, as it looks like right now. This is the policy mistake we are seeing. What follows is our view on positioning for this stagflationary scenario in 2022 and beyond.What this means for asset allocation

Abroad, China seems attractive in the emerging markets, given that the PBoC pivoted towards a more dovish stance in late 2021. Specifically, it removed the following phrases that were in prior reports: 1. the valve of money supply will be properly controlled, 2. refraining from adopting indiscriminate credit stimulus measures, 3. maintaining implementing normal monetary policy. This could be accompanied by an easing cycle starting in 2022, bolstering its equity market compared to the rest of the world.

Bonds: The short-Treasuries trade might seem overcrowded, but we still see downside potential. With inflation numbers expected to run high in the coming few months – and possibly surprises to the upside – we expect further room for selling pressure, especially on the short end of the curve. Additionally, with upward pressure on real yields coming from the accelerated taper and potential quantitative tightening, we are underweight US TIPS for 2022. With the above-described Fed policy mistake in mind, we remain bullish on the long end of the yield curve as economic growth prospects wane with more flattening on the 2s/10s. The multi-decade-long bond bull market has not ended yet in our view, even if this current period suggests the opposite.Historical 10 Year Treasury Yield (in %)

Disclaimer The information set forth herein has been obtained or derived from sources generally available to the public and believed by the authors to be reliable, but the authors do not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. This report should not be considered to be a recommendation by any individual affiliated with WUTIS – Trading and Investment Society e.V.