Rising Risks with soaring Mortgage Rates

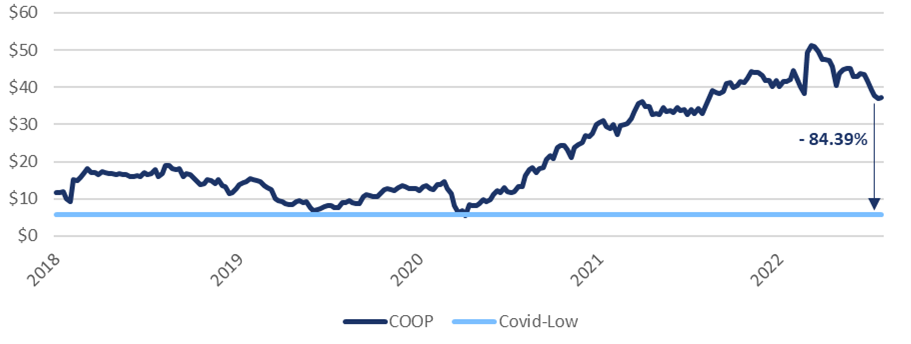

SHORT: Mortgage Lenders: Mr. Cooper ($COOP) and PennyMac ($PFSI)

Date of publishing: 06.07.2022

Executive Summary

- WUTIS expects turmoil for Mortgage Lenders with increasing Mortgage Rates

- The tremendous increase in mortgage rates leads to tumbling mortgage application rates

- Mortgage Lenders reached astounding valuation levels, fueled by accommodative FED policy

- This is the first time that the house to income ratio rises, although mortgage rates are also rising

- The planned policy steps by the FED will lift the mortgage rates even further, with every basis point increasing the pressure on mortgage lenders

- Mortgage Lenders are already preparing for tougher times

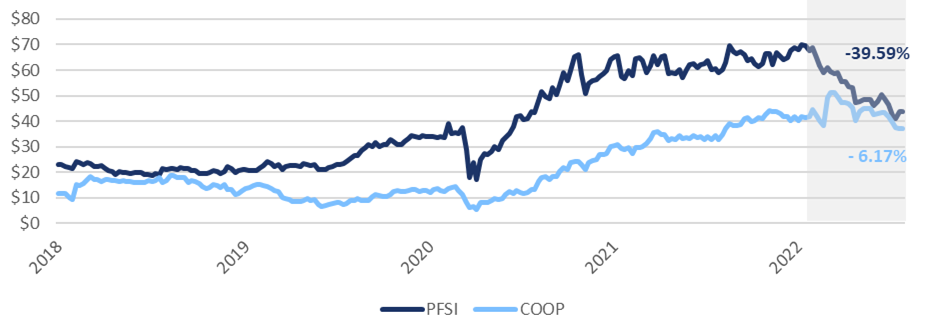

- Short Position in Mr. Cooper ($COOP) and PennyMac ($PFSI)

Introduction

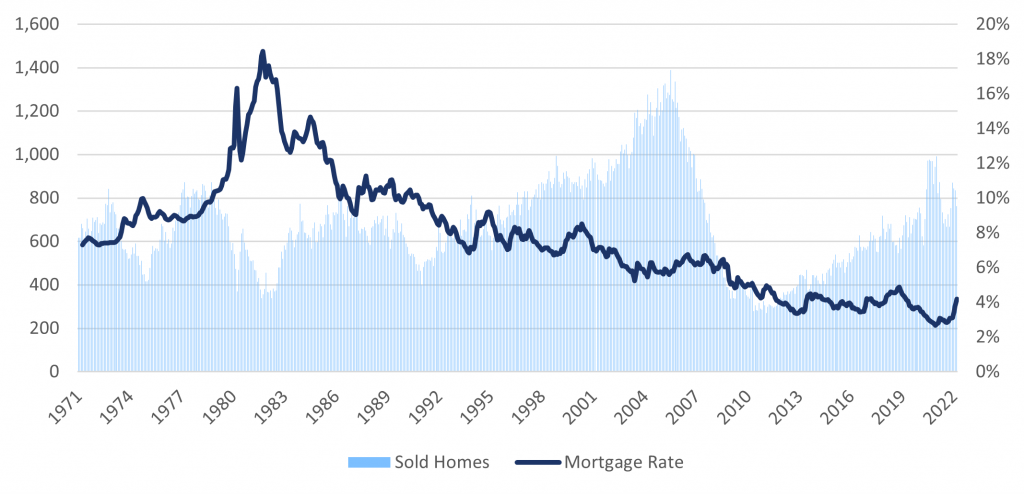

30-year fixed Mortgage Rate [1]

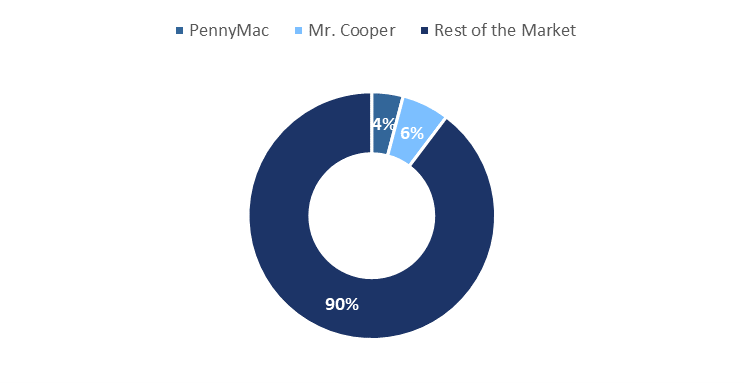

The following article elaborates on the housing-/mortgage market, implication on this sector from the economic policy, as well as an overview of two mortgage lenders with around 10% of total market share.

Macro-Economic Overview

Housing Market

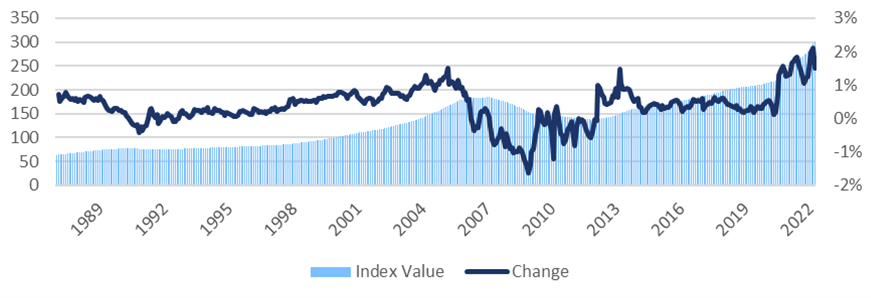

Case Shiller Index [2]

The problem with the Fed’s intended actions is that monetary policy works with a lag since the transmission mechanism of increasing the fed funds target rate takes time to trickle through to end consumers. One sensible reason for committing to rate hikes is that it wants to adjust inflation expectations. But do we need possibly seven rate hikes to achieve that adjustment? Inflation expectations based on the 5y5y forward inflation rate are hovering at 2%, the Fed’s medium to long term inflation target. This indicator was at its highest in mid-October 2021 at roughly 2.4%.

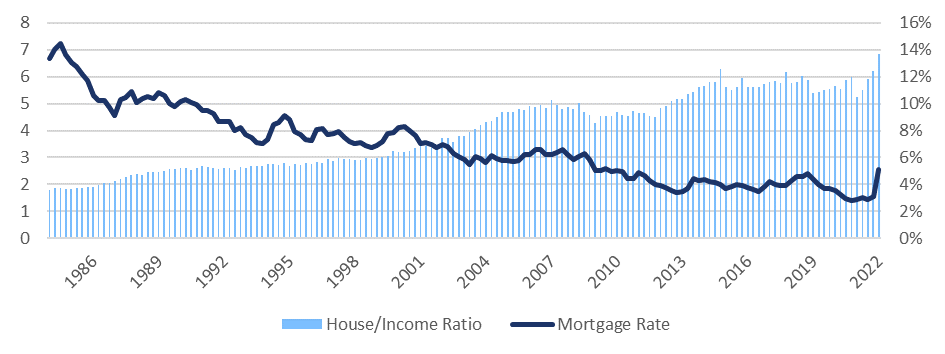

But it would be short sighted to only consider housing prices without their relation to the income of the US citizens.Ratio House/Income compared to mortgage rates [3]

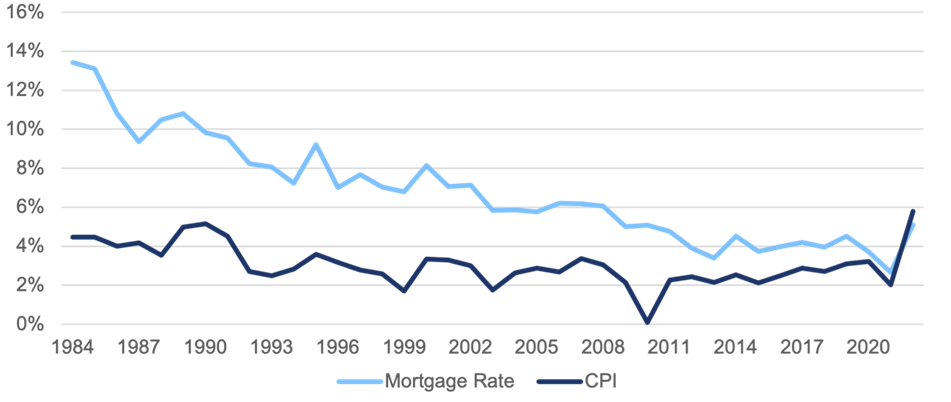

The ratio shows that real estate prices increased at a higher velocity than income. The ratio in 1984 was slightly under 2, indicating that a household needed 2 years to afford a home without any other expenses considered.

We can see that the house to income ratio increased constantly over the years, which indicates that income cannot keep up with rising house prices which means that the purchasing power of households decreased over time.

Since the financial crash starting in 2007 the ratio continued its inverse relationship with the mortgage rate to the current level, where an average household needs 6 years to afford a home. As already mentioned, until 2021 we have seen a rather negative correlation, which sounds also intuitive, as declining mortgage rates, make mortgages more affordable, thus demand for housing increases. Right now, the velocity of change significantly accelerated. As a result, private households face higher costs when financing real estate acquisitions.

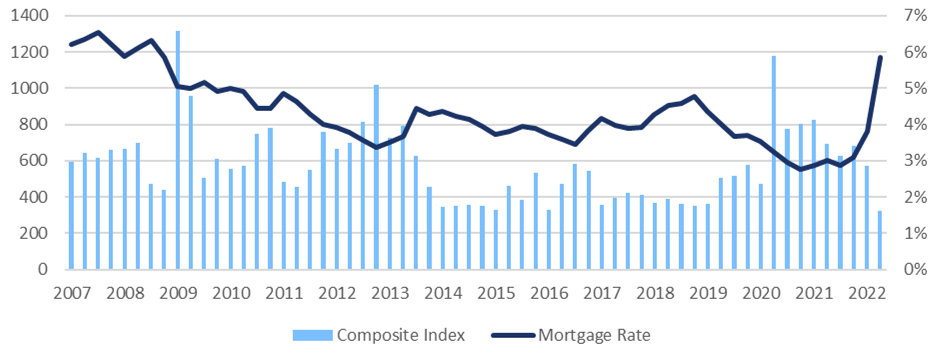

The implications of this development can be already seen in mortgage application numbers.

Mortgage Market

MBA Composite Index plotted with the Mortgage Rate [4]

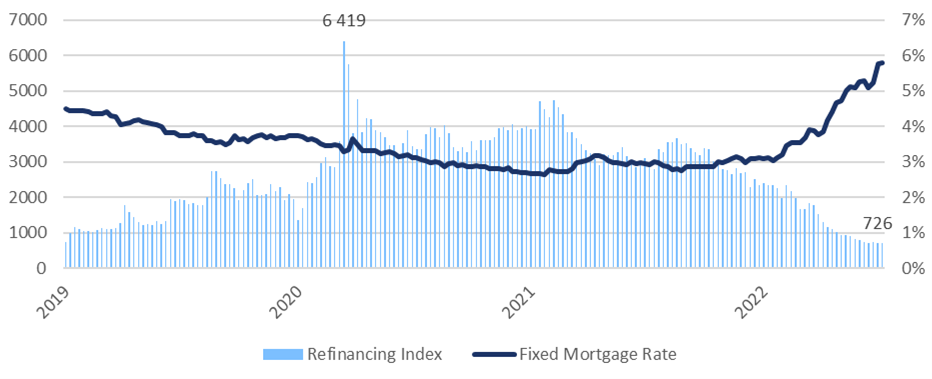

Refinancing Index [7]

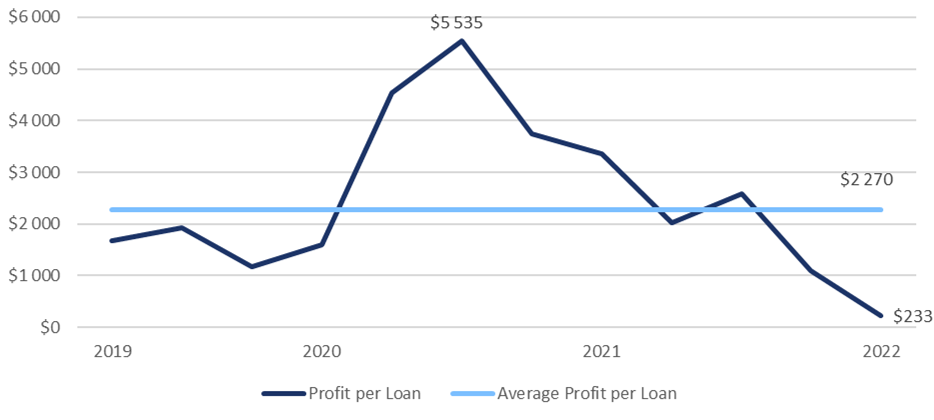

Profitability of Mortgage Loans [8]

Share of adjustable mortgages in the overall mortgage market [9]

Economic Data

Inflation

Fed Monetary Policy

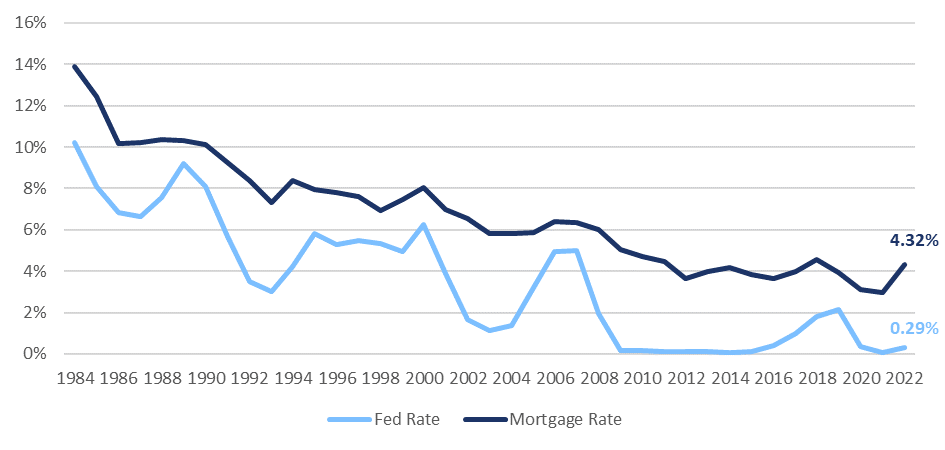

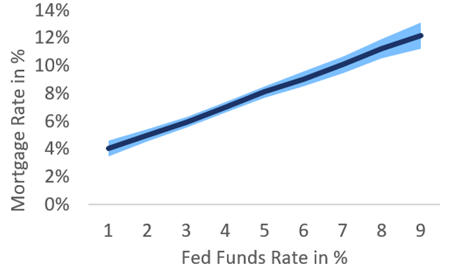

The Federal Reserve’s monetary policy is one of the most significant factors impacting interest rates and therefore also mortgage rates, which have a 0.97 correlation to the fed funds rate.

During the COVID-19 pandemic the Federal Reserve created excessive amounts of liquidity, with their quantitative easing operations, in order to lighten the consequences of the pandemic. Due to rising inflation and stagnant economic output the Fed started hiking rates in March 2022 by 0.25%. The last hike in June 2022 amounted to 0.75%, the largest increase since 2000, resulting in a Fed funds target rate of 1.5%-1.75%. It is expected that at the end of the year the Fed funds will reach a level of above 3%. The market also prices in a rate above 3% as can be seen in the Fed funds futures. Regarding the meeting probabilities of the Fed, a Fed fund rate between 3% and 3.5% is estimated with a probability of 68%.Fed Funds Futures [12]

The Federal Reserve also announced to implement quantitative tightening in order to reduce their $9 trillion balance sheet, they started in June with their first sell-off, including the reduction of mortgage-backed securities by $17.5 billion.

Restricting the money supply is pushing rates higher, including mortgage rates.Economic Growth

Slowing economic growth (decline by 1.4% Q1) makes it less interesting for individuals to get a mortgage and mortgage lenders need to price in the risk of default, resulting in a further rise of mortgage rates.

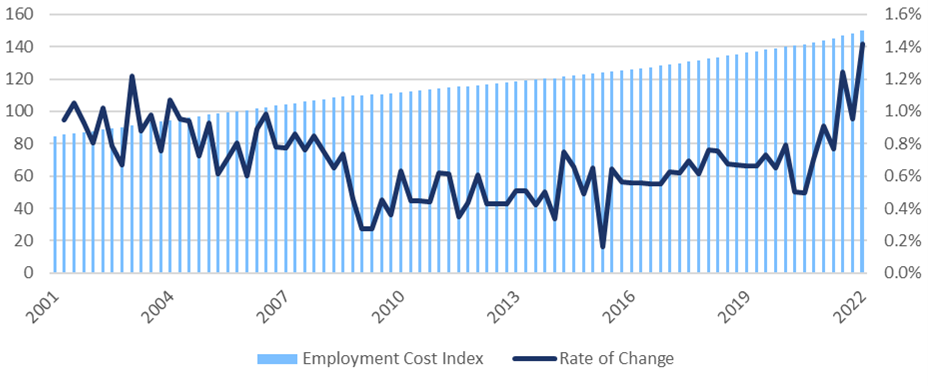

In the US, wages have risen with the highest velocity since 2006 due to an extremely tight labour market. Higher wages are also impacting mortgage lenders. Indicated by the employment cost index, from 2001 until 2022 the cost of employment increased, but since 2020 the rate of change surged.Employment Cost Index [13]

Bond Market

There is a strong correlation between the 30-year treasury yield and the 30-year fixed mortgage rate. It can be observed that the yield of T-Bonds is most of the time beneath the US 30-year mortgage rate. Although maturities are similar, while mortgages depend on individual payments US treasury bonds are backed by the US government, thus a risk premium is included.

Concluding that the general environment of the bond market, has an indirect influence on how much mortgage lenders charge for mortgages. In the mortgage-backed securities (MBS) market, banks offering these investment products need to provide a competitive yield to attract investors, as government bonds and corporate bonds offer lucrative yields in the long run.

QUANTITATIVE MODEL

Background

According to the individual committee members’ expectations of the midpoint of the target range, the Fed’s benchmark rate will reach 3.4 percent in December 2022. This hike in the fed funds rate is also reflected in the fed funds futures for December 2022, while the rates in 2023 hover around 3.6 percent.[16] Additionally, the committee projects a rise in the fed rate to 3.8 percent by the end of 2023. With these expected hikes in the fed rate over the following months, there is also a high probability that mortgage rates will continue to rise and put even more pressure on mortgage lenders.

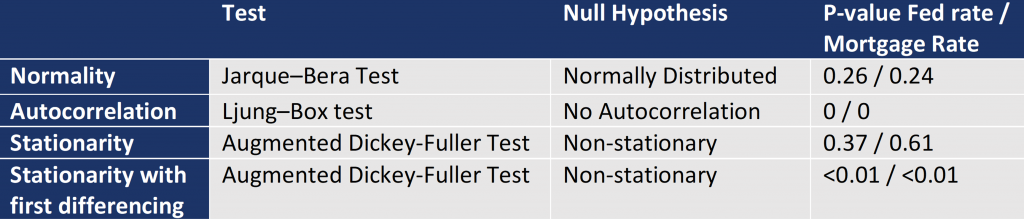

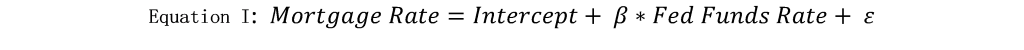

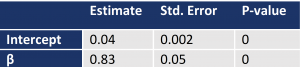

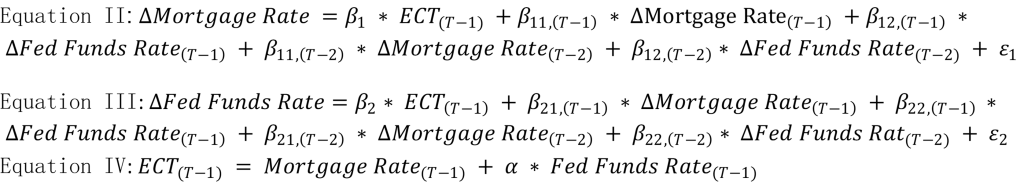

To evaluate the possible impact on the mortgage rate, a Simple Linear Ordinary Least Squares Regression model is initially applied to get an insight into the relationship between the variables. To go beyond this simplistic lens, a Vector Error Correction Model (=VECM) is implemented to meet the needs of the data and find more reliable estimates.

The data used for the regression models are the yearly average fed funds rate and the yearly average US 30-year fixed mortgage rate as visualized in Figure 11. The data for both variables has been taken from 1984 to 2022, where the rates for 2022 are calculated using available data from the first half of 2022.

The data used for the regression models are the yearly average fed funds rate and the yearly average US 30-year fixed mortgage rate as visualized in Figure 11. The data for both variables has been taken from 1984 to 2022, where the rates for 2022 are calculated using available data from the first half of 2022.

Simple Linear OLS Regression

Vector Error Correction Model

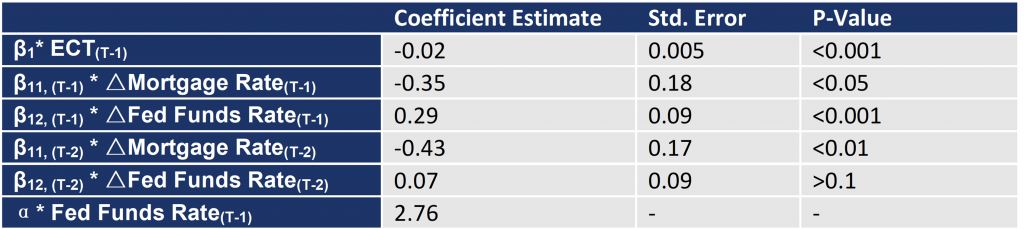

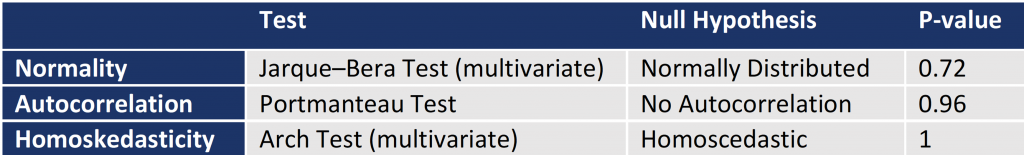

The coefficient estimate of the long-run relationship ECT is negative and statistically significant, allowing the interpretation that the previous periods deviation from the long run equilibrium is corrected in the current period at a speed of adjustment of 2 percent. This confirms the long run equilibrium relationship between mortgage rates and fed funds rates, where the process slowly converges to the long-run equilibrium after short-term shocks.

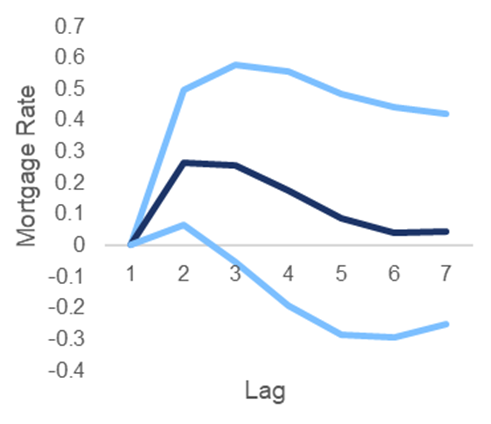

With regards to the short-run causal relationship between mortgage rates and fed fund rates, it can be concluded that there is a positive causal relationship where changes in the fed funds rate from previous periods cause current changes in the mortgage rate. The coefficient estimates for both lags are positive and the coefficient for the lag of one for the change in fed funds rate is statistically significant. Causality tests including the Wald test have been conducted to confirm these results, where fed funds rate do granger cause mortgage rates. Hence, past values of fed funds rates help predict future values of mortgage rates.

Impulse Response from Fed Funds Rate

A one standard deviation shock in the change in the error term for the average annual fed funds rate would lead to a 0.3 standard deviation increase in the change in mortgage rates at lag 2. This impact would last to a small degree in the long term, while it is only statistically significant one period after the shock (at lag 2). Additionally, there are no instantaneous changes from shocks in the change in the fed funds rate.

Even though the VECM uses the differenced time-series for the coefficient estimates, requiring some interpretations to be in terms of the change in the rates, the predictions of the VECM model are still conducted for the average annual mortgage rates and average annual fed funds rates. With the expectation that the average annual fed funds rates will be around 3.6 percent throughout 2023 as discussed above, the upper limit forecasts have been used to estimate what the average annual mortgage rate would be. With the upper limit prediction of 3.6 percent for the fed funds rate in 2023, the predictions for the average annual mortgage rate is 5.7 in 2023 and 6.6 percent in 2024. This constitutes a 1.4 percent and 2.3 percent increase from the current annual average mortgage rate respectively. Such mortgage rate increases would put even more pressure on mortgage lenders.Mortgage Lender

Overview of the Mortgage Lenders

Fundamental Findings

Financial Health

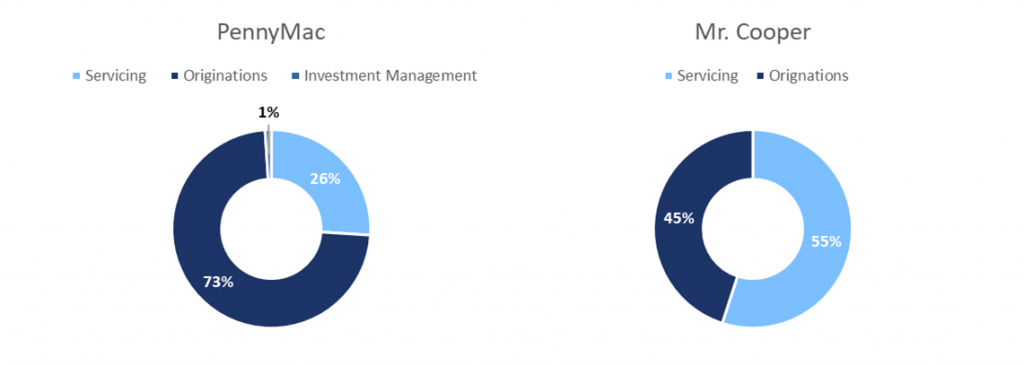

Although these developments are already catching some interest, there is definitely more to find when by looking at the financial statements.

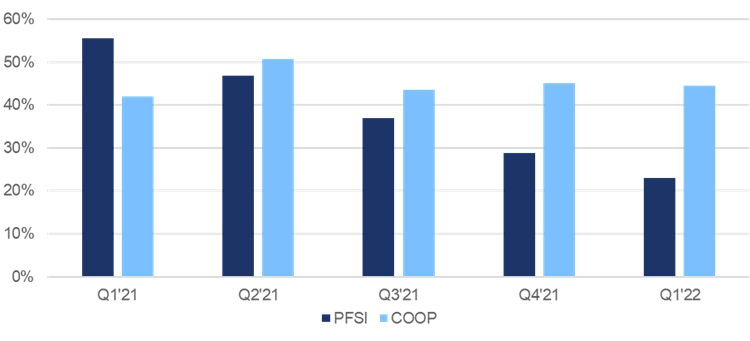

The so to speak father of value investing, Warren Buffett, has many different ratios he likes to look at, but one of the most important ones in his opinion is the Return on Equity (ROE) and especially the development over the years. Telling the investors how profitable their funds are invested.

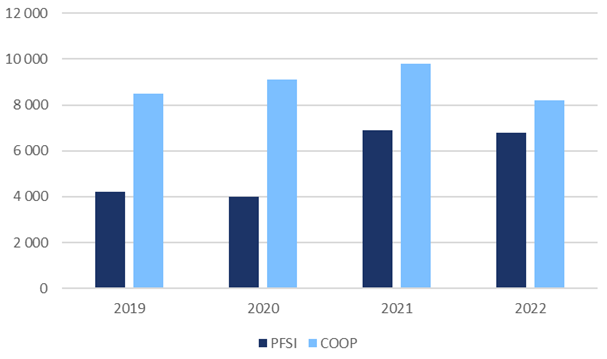

Production Segment Pre-Tax Income PennyMac: [28]

The development of a decrease of 90%, just from Q4’21 to Q1’22, can be immediately noticed, the decrease looks even more worrisome of you have a look at the year-over-year development. Which decreased from $380 million to just $9 million. The reasons for that, according to PFSI, have been substantial decreases of margins as well as diminishing volumes.

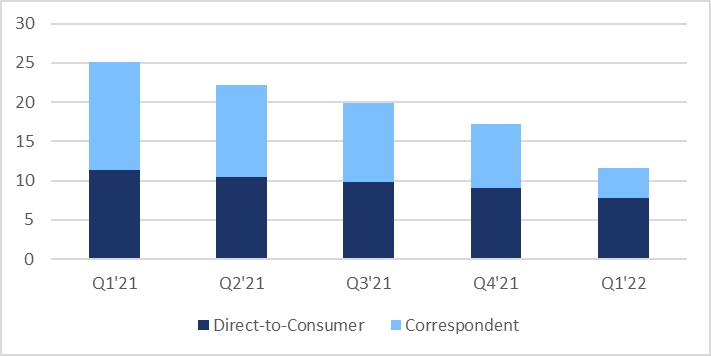

Speaking of funded volume Mr. Cooper shared in their recent report data of the development of it’s mortgage volumes they have funded in the recent quarters.Funded Volume (in billions) by Mr Cooper [29]

Conclusion

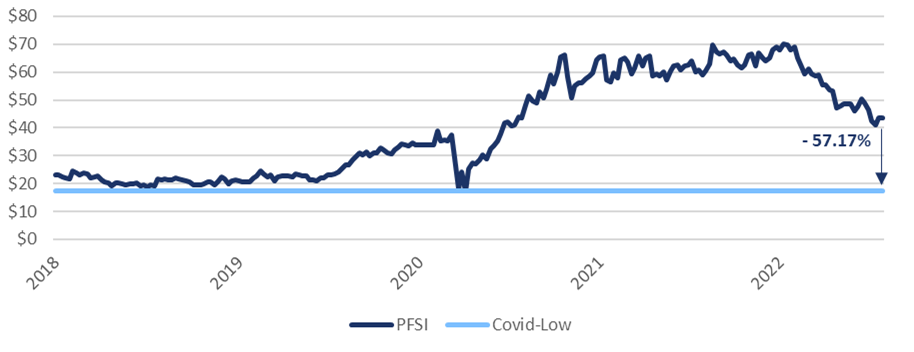

PennyMac [30]

Mr. Cooper. [31]

Monthly home sales [31] (in thousand)

Disclaimer The information set forth herein has been obtained or derived from sources generally available to the public and believed by the authors to be reliable, but the authors do not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. This report should not be considered to be a recommendation by any individual affiliated with WUTIS – Trading and Investment Society e.V.