Profiteers of a booming Energy Market

LONG: iShares U.S. Oil Equipment & Services ETF ($IEZ)

Date of publishing: 02.02.2022

Executive Summary

- WUTIS expects investments in the Oil & Gas industry to increase in 2022

- High profitability of Crude Oil wells, elevated political tensions and ongoing inflation concerns point to further increasing Oil Prices

- Oil Producers and Equipment Manufacturers recovered 2020 demand gap throughout 2021

- Long Position in iShares U.S. Oil Equipment & Services ETF ($IEZ) and individual holdings $SLB & $BKR

Introduction

Market Environment

COVID-19

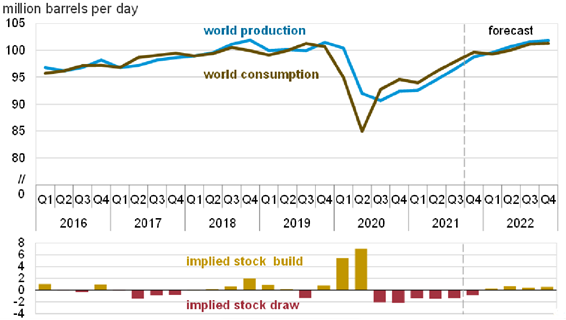

As global consensus grows on the Omicron-variant occuring milder than previous variants, the prospects of global oil markets are promising. Additionally, current reports did not factor in a higher demand as the Energy Information Administration (EIA) was expecting demand declines due to the beginning uncertainty with the emergence of the variant, still negatively accounted for in the consumption and production graph above. [1]

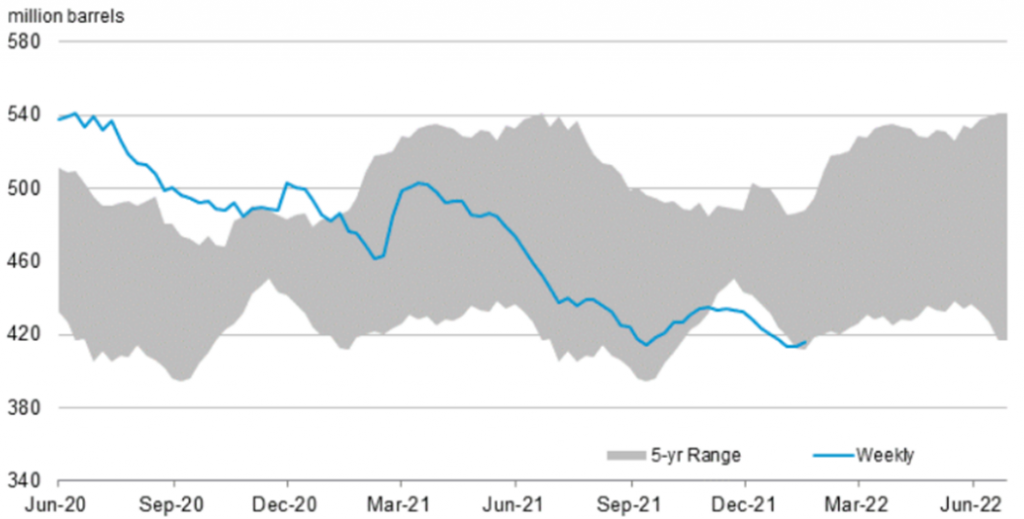

Declining Storages

Crude Oil Demand and the US-Dollar

OPEC

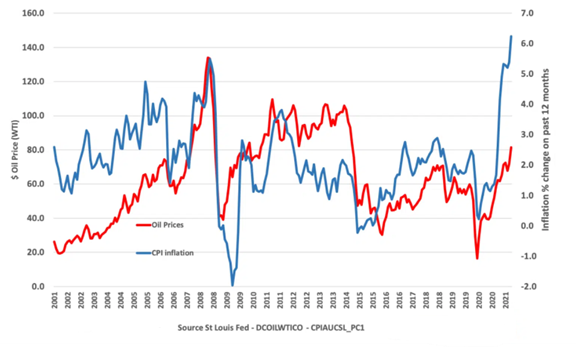

Inflation Rates

Political Landscape

Russia/Ukraine

Iran nuclear deal

The Biden administration pledged to revive the Iran nuclear deal. However, as circumstances have changed and it is expected that a less robust, compromised deal to be settled.[8] The reason behind this is strongly political as Biden’s unpopularity is surging and something as little as a bad nuclear deal might help increase his popularity again. One of the drivers of his unpopularity are the high oil prices in 2021 (Brent Crude Oil’s 2021 average spot price at $71 a barrel compared to $42 a barrel, in 2020).

Due to US sanctions, Iran was exporting at historic lows of less than two million barrels a day in 2020. Thus, reserves as high as 120 million barrels are expected to be able to be brought to the market almost immediately, which poses one of the major risks to our trade as we assume that unlike the OPEC’s supply increases this risk is not priced in yet. Furthermore, Iran has already announced to scale up production back to 4 million barrels a day as soon as this spring. With the OPEC+ routinely falling short of the needed supply, Iran could lower global prices up to 10%. This might also explain the White House’s silence on Iran’s compliance.

Fundamental Analysis

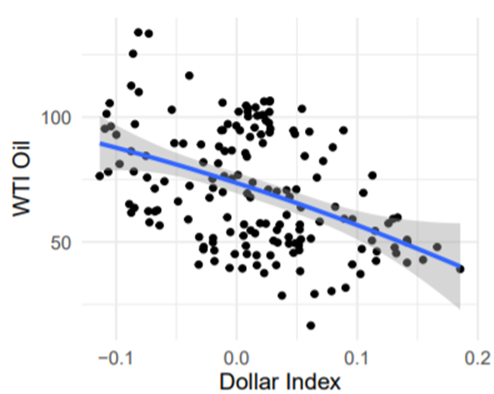

Crude Oil Demand and the US-Dollar

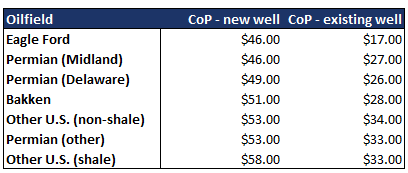

Cost of Production

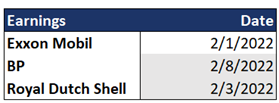

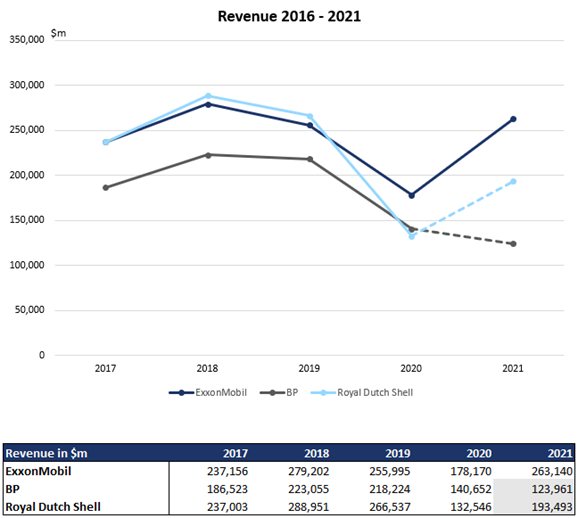

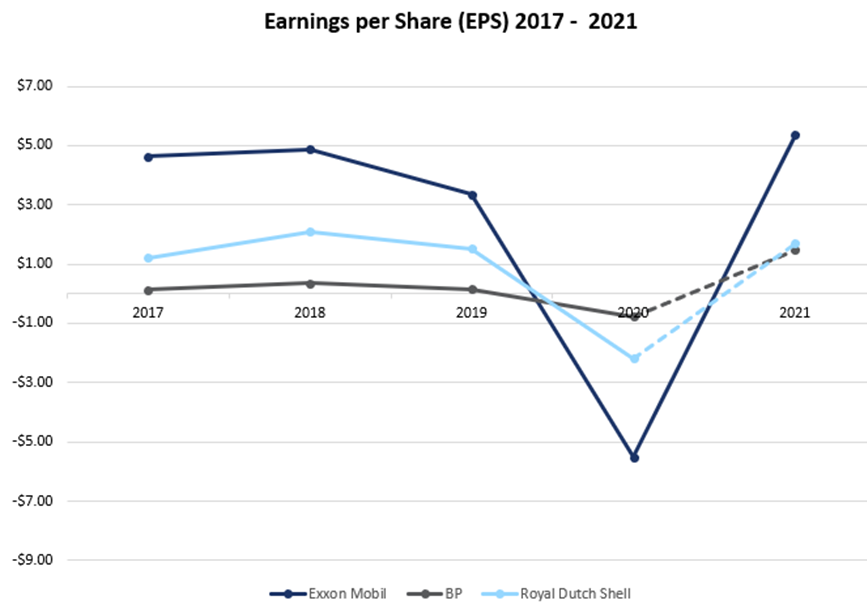

Oil Companies

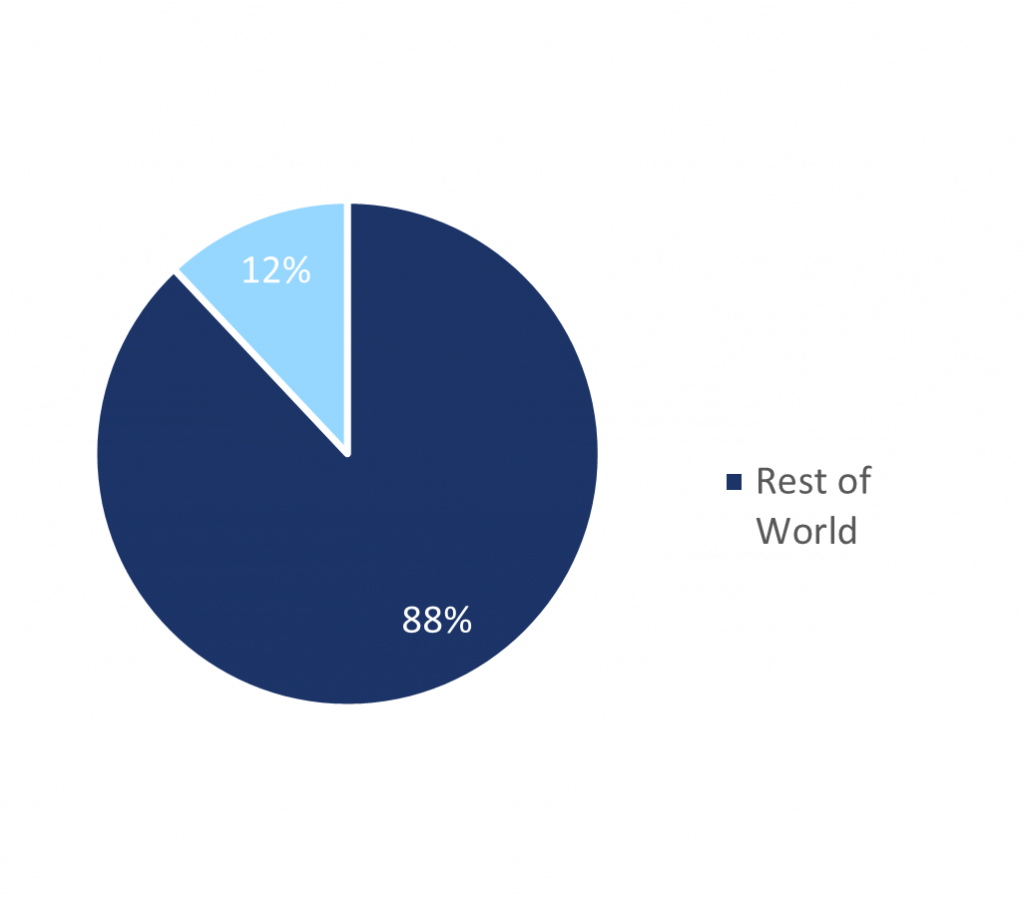

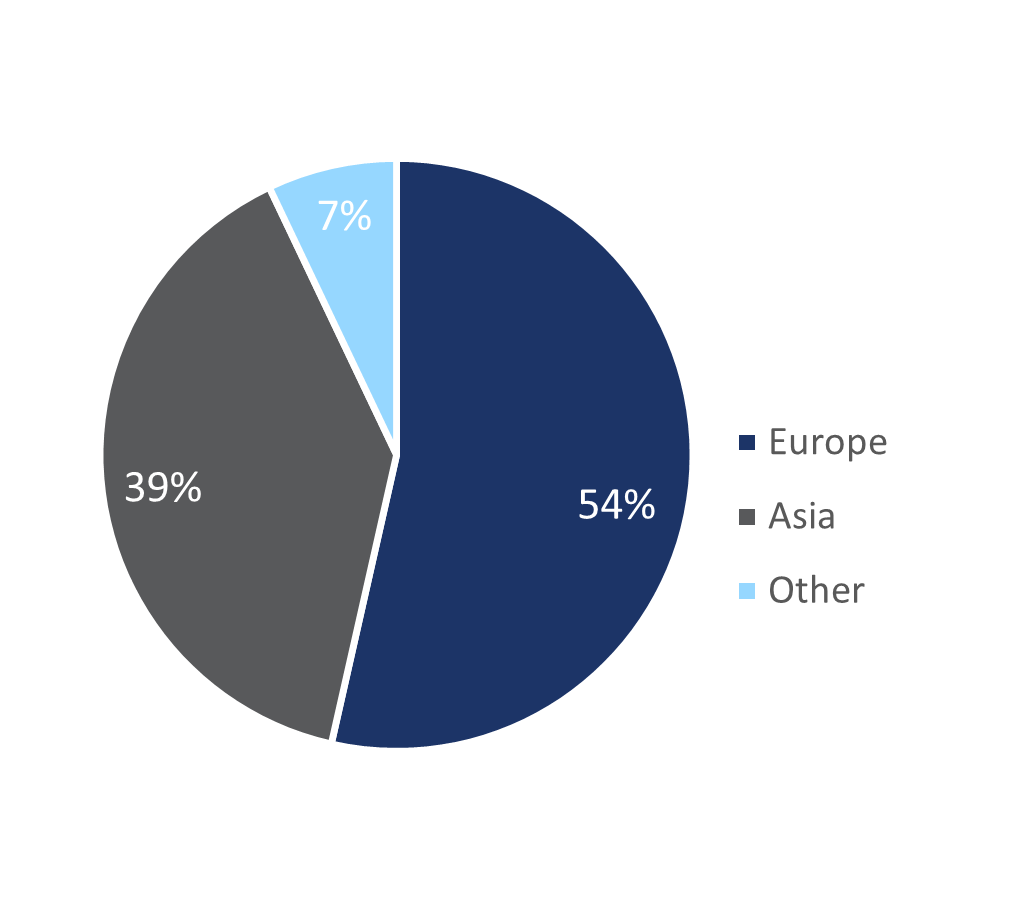

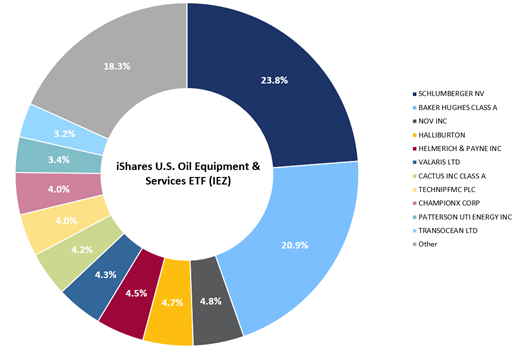

Holdings of the iShares U.S. Oil Equipment & Services ETF ($IEZ)

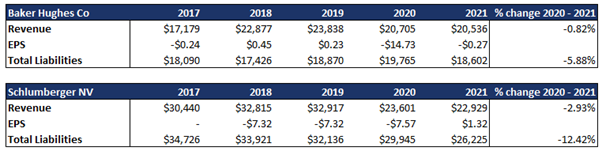

(Schlumberger, Baker Hughes and Halliburton already reported 2021 Results)

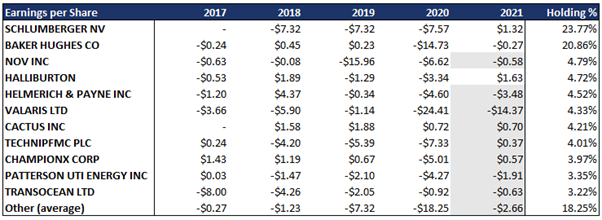

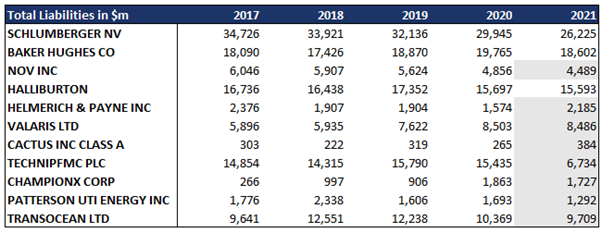

We can see that all Holdings of the $IEZ show a positive EPS growth from 2020 to the Q3 2021. As the current earnings season is ongoing, we will further monitor their outcomes, but expect overall positive releases, as well as further stabilizing results of the oil and gas equipment and service industry.

Although, we should not neglect previous years, many of these companies have not been profitable. One of the reasons could be the reduction of liabilities. 9 out of the 11 biggest holdings (accounting for around 82% in $IEZ) have significantly reduced their debt level from 2020 to 2021. On average, by 13.38%.

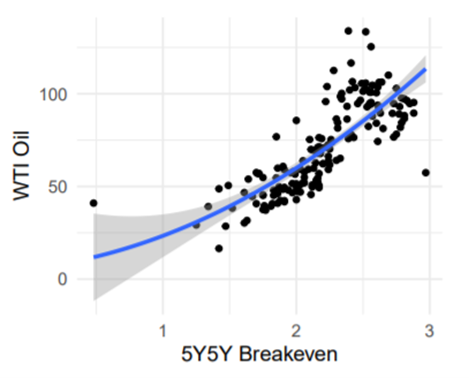

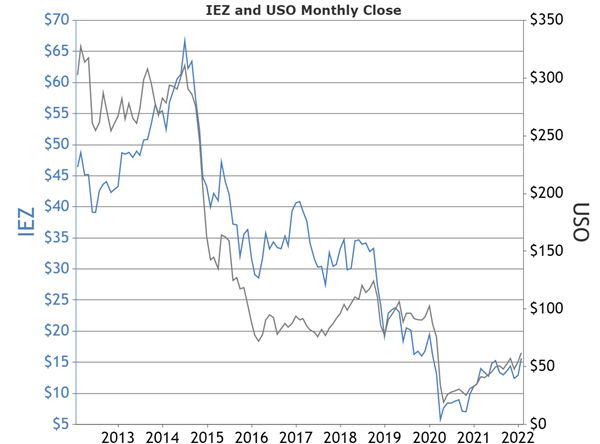

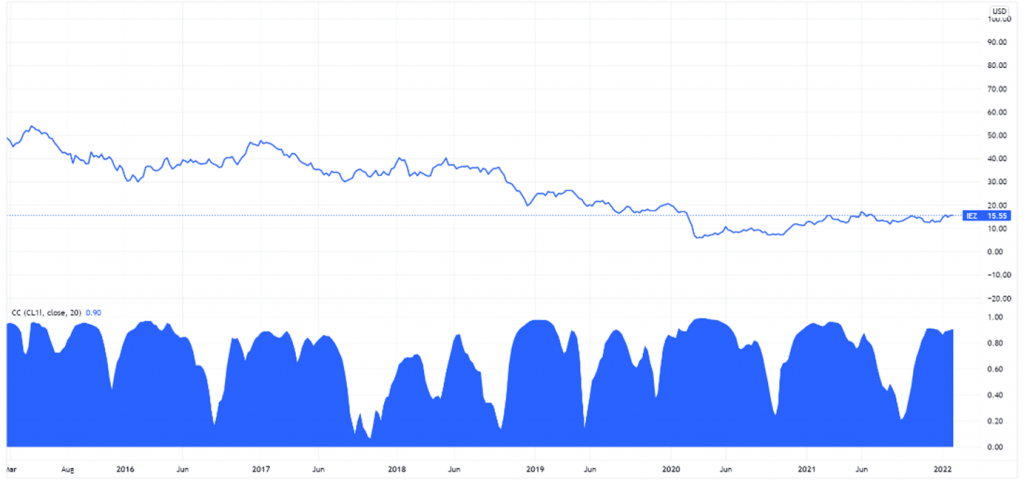

Correlation

Schlumberger NV and Baker Hughes Co

Trade Strategy

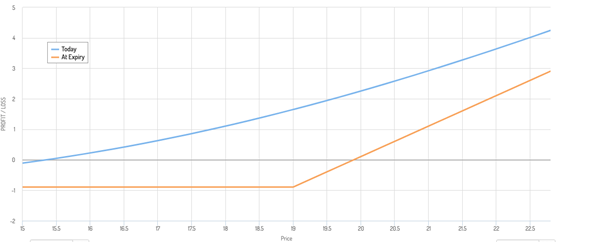

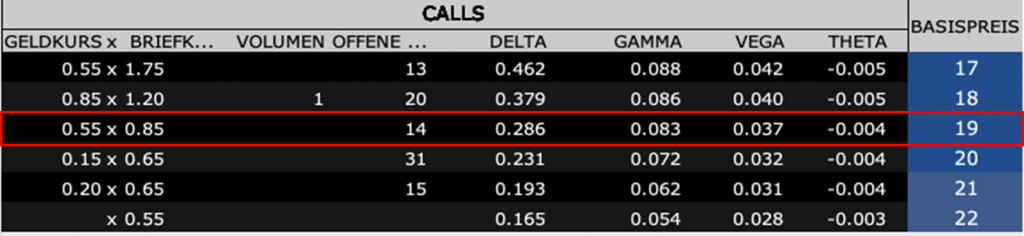

For the ETF, only buying OTM Calls seem of interest to us. Visible in the option chain, traded volume and open interest on $IEZ are extremely low, entering a suboptimal market with regards to liquidity. As the risk is to enter the trade at an unportioned high price, more complex strategies like a calendar spread or a diagonal spread currently do not present a way to trade this underlying at the moment. Consequential the profit/risk ratio is not lucrative enough, paying out low premium and coming with higher potential losses.

Nevertheless, as Schlumberger ($SLB) and Baker Hughes ($BKR) make up a significant share of the ETF, we also take a position in these holdings to support the thesis.

Both have more favourable volume and open Interest compared to $IEZ. Therefore, a more exotic trading strategy might fit. Christmas Tree Butterfly with calls, consisting of a long call, three higher positioned short calls and two long calls above the three sold calls. Similar to standard butterfly spreads yet giving the strategy a bullish directional exposure.

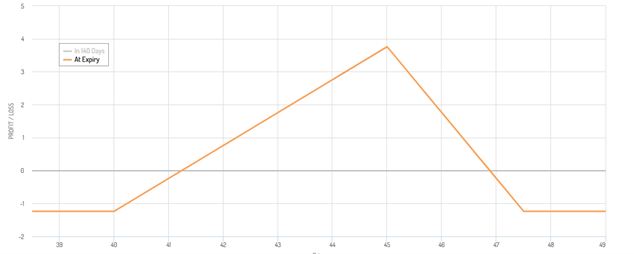

$SLB closed at $39.07. Trading the June contract (expiry: June 17th 2022), a long call at $40 with a delta of 0.53, three short calls at $45 with a delta of 0.35 and two long calls at $47.5 with a delta of 0.27. The implied volatility is at 43.6%. For this setup, a premium of $140 needs to be paid. The maximum profit is as high as $382. This results in a R:R of 2.7.

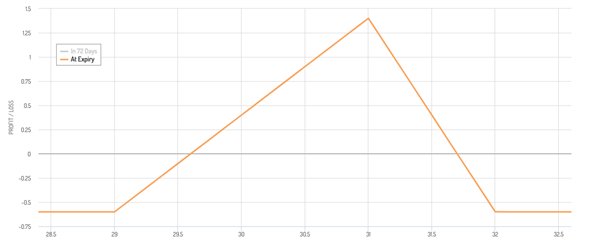

$BKR closed $26.90. Setting up a Christmas Tree Butterfly with calls for the April 14th 2022 contract, Long call at 29 with a delta of 0.395, Short three contracts of the $31 calls with a delta of 0.25 and Long two calls at $32 with a delta of 0.194. The implied volatility is at 40.9% whilst the historic volatility is above the current IV at 45.3%, meaning that option prices might be discounted. Debit paid for this trade is $60. The maximum gain is $140, resulting in a R:R of 2.3.

References

- Fuels Market Outlook, EIA Short-Term Energy Outlook

- U.S. Energy Information Administration, Crude oil futures and estimated contract prices

- OPEC, 24th OPEC and non-OPEC Ministerial Meeting

- Reuters, OPEC+ agrees oil output increase from February

- Federal Reserve Bank of St. Louis, How Much Do Oil Prices Affect Inflation?

- Forbes, Why Is Inflation So High?

- ING, Commodity prices could soar if the Russia-Ukraine crisis escalates

- WSJ, Inflation Gives Biden an Incentive for a Bad Iran Deal

- Statista, Average WTI price needed for U.S. oil and gas producers to stay profitable by well status in selected U.S. oilfields as of 2022

Disclaimer The information set forth herein has been obtained or derived from sources generally available to the public and believed by the authors to be reliable, but the authors do not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. This report should not be considered to be a recommendation by any individual affiliated with WUTIS – Trading and Investment Society e.V.