EUR/USD Parity elevating pressures on US companies

Date of publishing: 12.09.2022

Executive Summary

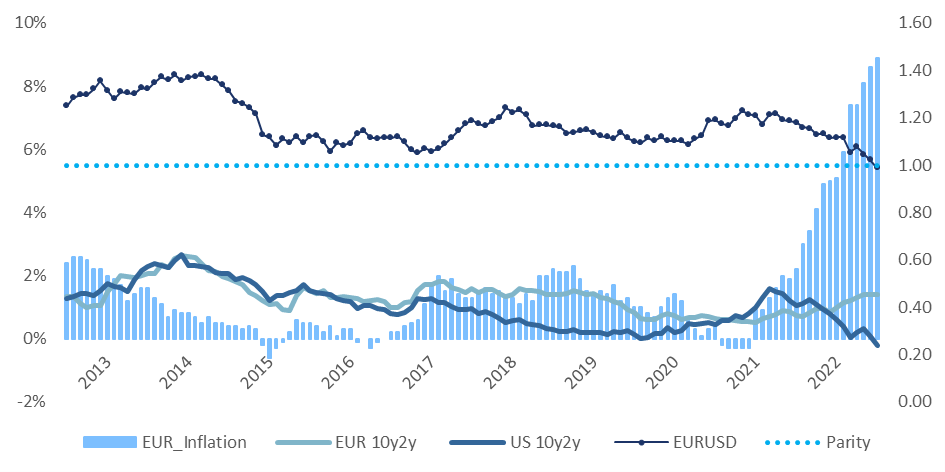

- EUR/USD is trading at parity for the first time in 20 years

- Several economic indicators show significant headwinds for the European economy

- Facing a possible recession and having the EUR/USD at parity exposes US corporations, which derive a significant share of their revenue from Europe to serious risk

- Many US corporations make more than 40% of their revenue in Europe

Introduction

Current Situation in the West

Something similar could have been heard in the news over recent months. Record high inflation in the USA and Europe is one of the major problems our societies face at the moment, at least it appears so. The different reactions by the respective central banks lead to constant changes in the Foreign Exchange markets. The hawkish stance by the Fed strengthened the Dollar compared to the Euro, as the Fed already started hiking its key interest rate earlier this year[2] and it took the ECB more than a quarter[3] to follow the Fed’s lead. Another reason is the importance of the USD as a reserve currency and in times of distress many investors flee towards the USD, strengthening the currency further, and on the other hand gives the Fed the chance to react more stringent to the US inflation.

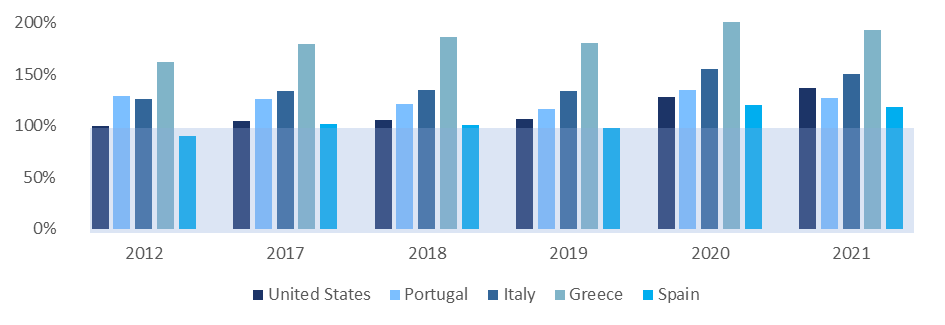

One of the reasons for the reluctance of the ECB to hike its key interest rate significantly is the high indebtedness by some of the European states, in 2012 they were already labelled as “P-I–(I)-G-S”[4].

Why the Parity matters

European Recession Risks

Factors that are currently moving markets most significantly besides the already mentioned high inflationary pressures, are Russia’s invasion of Ukraine, China’s influence on most supply chains and rising tensions around Taiwan, but that is not all.

Whilst the financials of eurozone companies seem to remain stable, increasing interest rates will most likely put an end to that. Cost of capital is already rising which will particularly hit highly leveraged and small cap firms.

What makes the current situation especially treacherous is the combination of a possible recession and war. In most recessions so far, demand went down and consequently resolved inflation, whereas in this scenario inflation and commodity prices will most likely continue to rise. This is a development that has not been seen in recent decades and central banks therefore must decide which mandate they want to fulfil in order to tackle stagflationary risks.

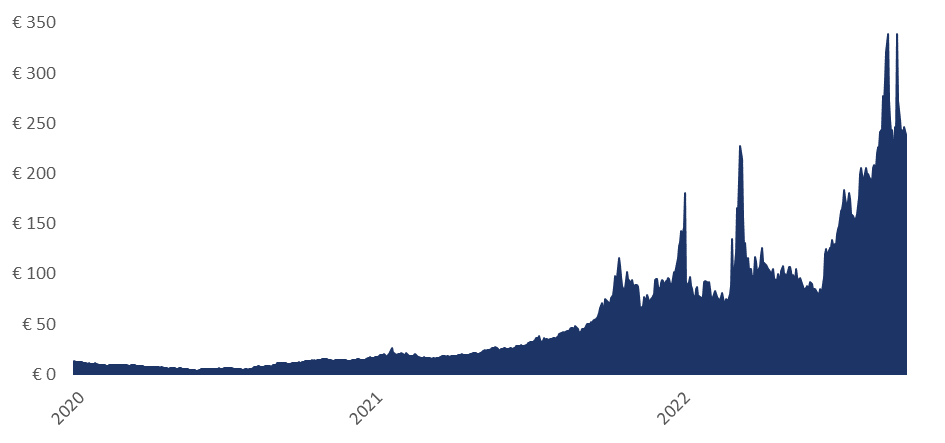

One of the charts signalling a dramatic rise in costs for the whole European economy are the natural gas futures for Europe.

Starting with the invasion of Ukraine and the fear of being cut off from Europe’s most important gas supplier the volatility and price of European gas futures increased significantly, not only affecting regular European households but having a detrimental impact on the European industry, which was and still is heavily relying on Russian gas in one way or the other.

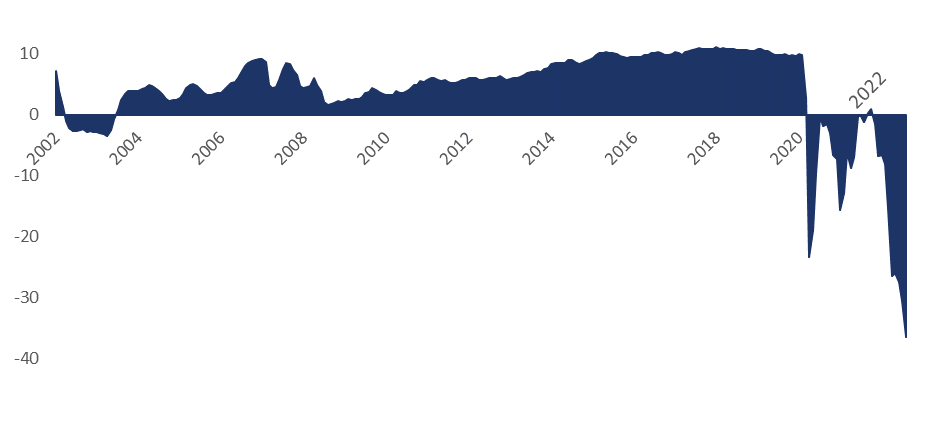

The development of the overall inflation also significantly fuelled by rising energy costs has led to an astonishing decline in the consumer confidence in the biggest economy of Europe, Germany.

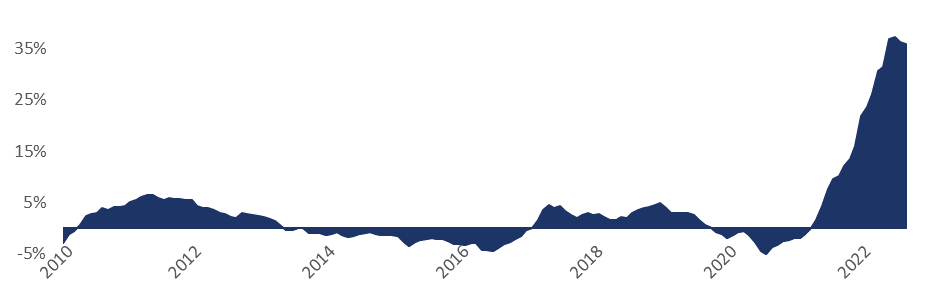

Last but not least, an important index to have a look at is the Producer Price Index (PPI) as it shows the average change over time in the selling prices received by domestic producers for their products. The PPI for the Eurozone shows a staggering increase since the end of 2021, exceeding any of the last 12 years. This figure clearly shows us an unusual change in prices in the business-to-business market, which once again puts further pressure on the European economy.

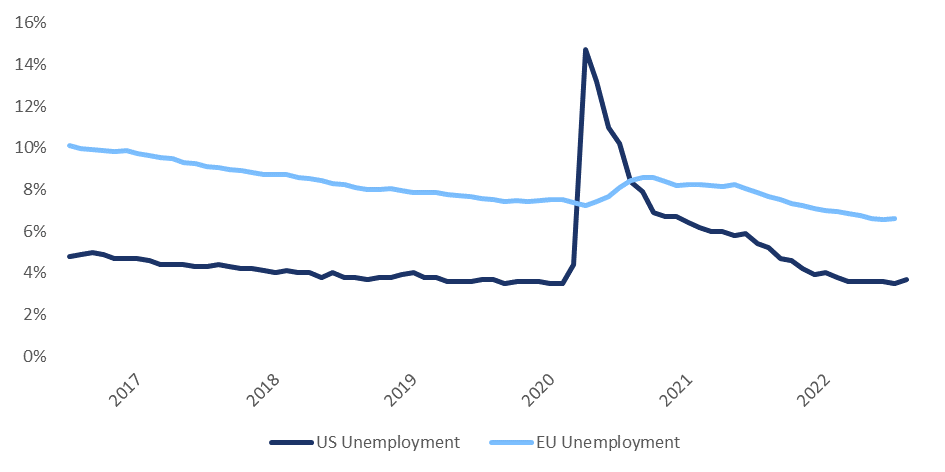

It is safe to say that a situation as we have it at the moment bears high risks of a recession, although the classic warning signs have not yet emerged – unemployment is still decreasing, and corporate profit margins remain stable. But if we look to the US, which – with two consecutive quarters of negative GDP growth – now more or less officially entered a recession, their numbers did not forecast that either.Companies that fit out criterion

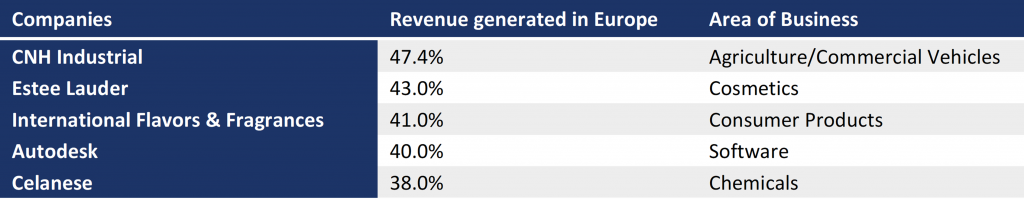

As can be seen the selected companies have made at least 38% of their revenue in Europe and with CNH Industrial we have a company which generates almost 50% of its revenue in the Euro-Zone.

It is Important to mention though, that there are also other companies with high percentage wise exposure to the Euro, though not all companies are impacted the same by the EUR/USD parity other the other mentioned factors. For this reason, we excluded companies which could be regarded as safe havens, operating in the medical space and producers of consumer goods like food, beverages and tobacco.

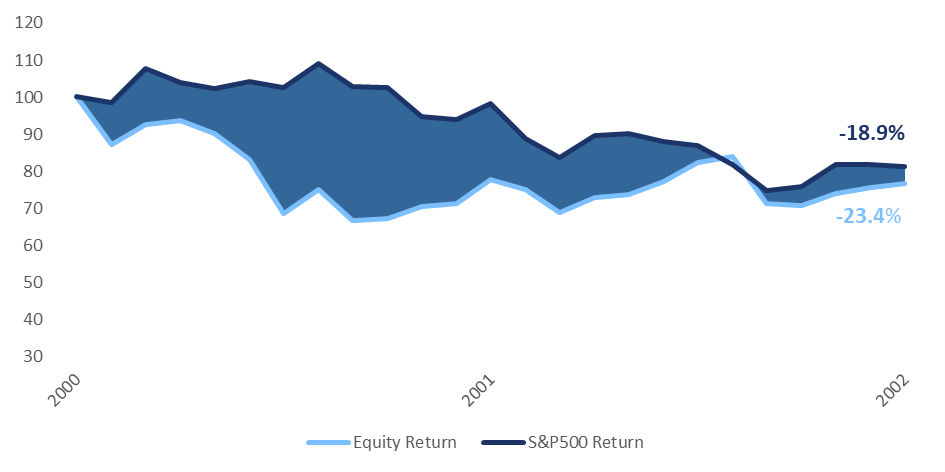

Looking at the historic performance of the respective companies compared with the S&P500 we can see that back during the time when we’ve already seen a EUR/USD parity as well as a recession, the respective companies performed considerably worse (-4.5%) than the S&P500 itself.

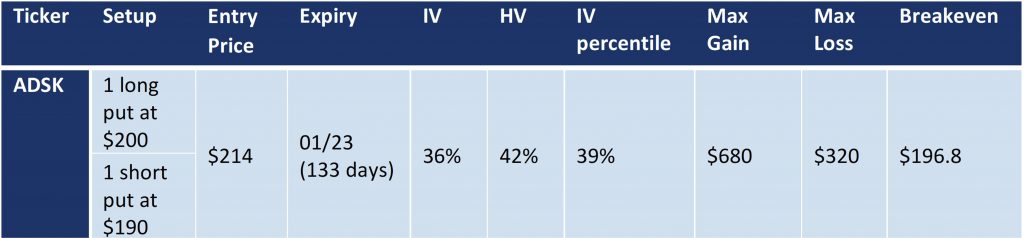

Trade Structure

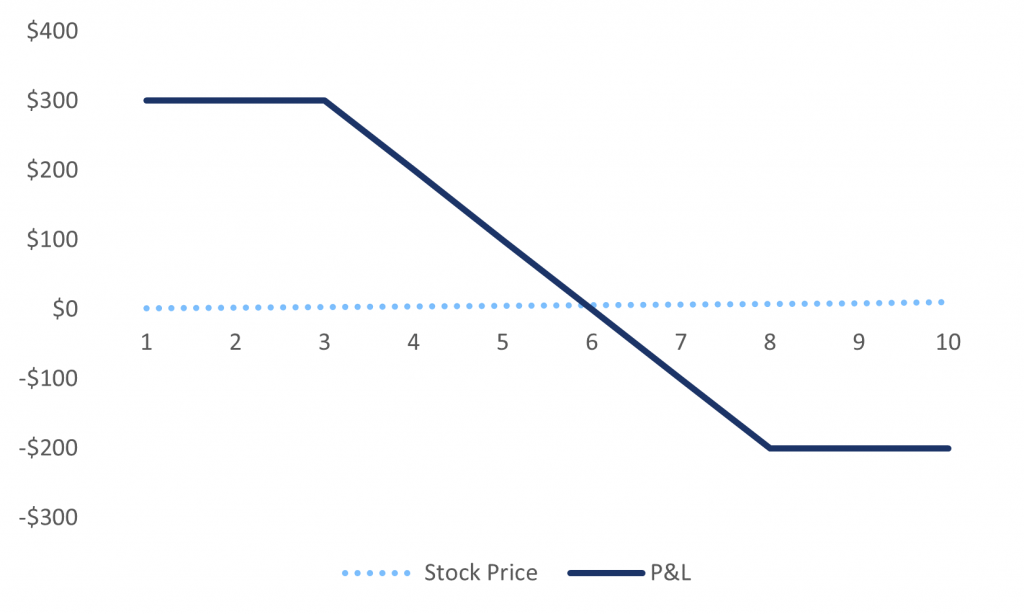

Bear-Put Spread

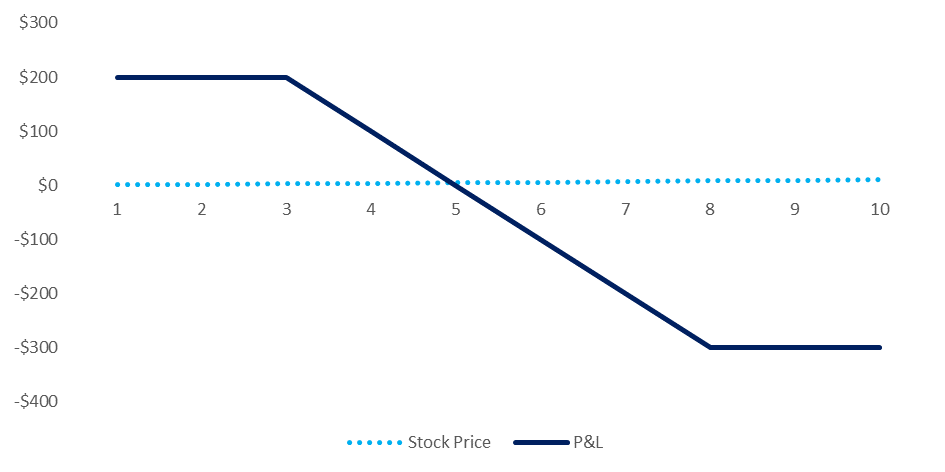

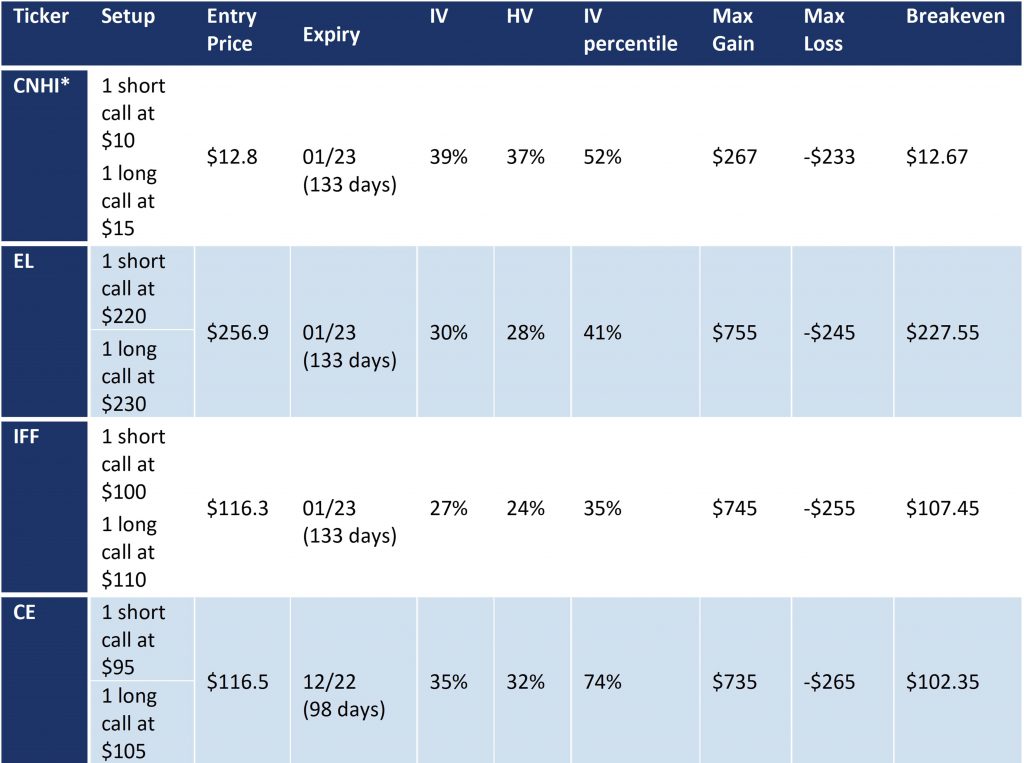

Bear-Call Spread

Summary

Disclaimer The information set forth herein has been obtained or derived from sources generally available to the public and believed by the authors to be reliable, but the authors do not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. This report should not be considered to be a recommendation by any individual affiliated with WUTIS – Trading and Investment Society e.V.