European Quality as a Return Driver

Defensive Equity Portfolio

Date of publishing: 20.07.2022

Executive Summary

- Factor Investing Strategy focused on the European Market with the objective of finding Quality-/Value Stocks (screened from 2013-2016 and back-tested from 2017-2022)

- Goal of minimizing drawdowns and creating a stable portfolio through a selected choice of Quality Stocks and the potential implementation of a Rolling-put Strategy as a supportive measure

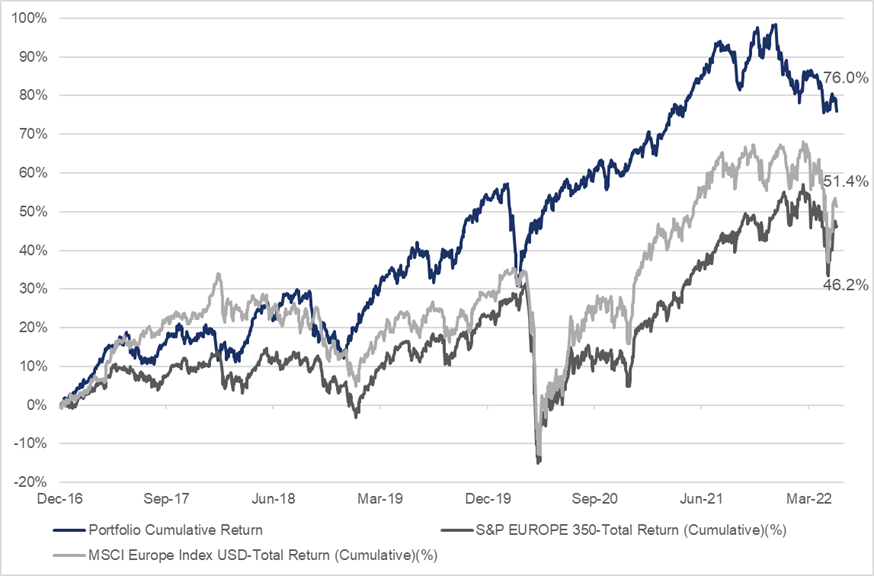

- Over the back-testing period our Portfolio significantly outperformed the benchmark indices (S&P EUROPE 350, MSCI Europe)

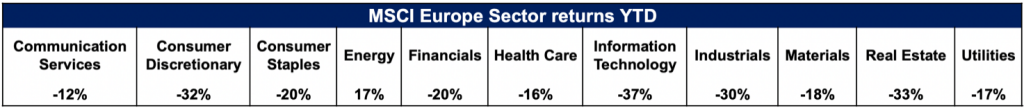

- Macro Analysis of affected sectors suggests rough times ahead for information technology, materials and industrials whilst healthcare and consumer discretionary (especially established/luxury brands) show more stability in those volatile times

Introduction

Strategy and Investment Approach

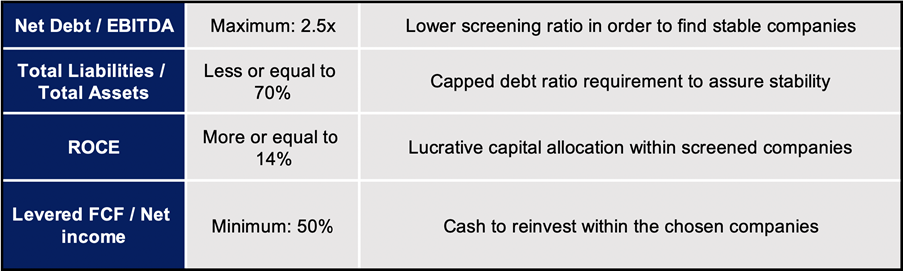

Fundamental Criteria

Qualitative Criteria

Portfolio Allocation

Sector Allocation

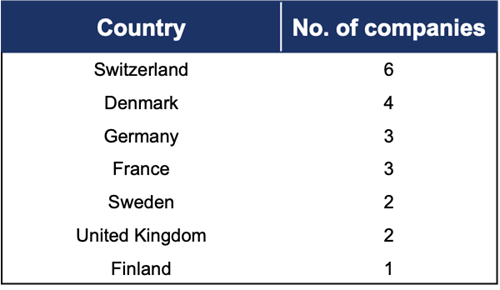

Country Allocation

In terms of geographical locations of the companies, we have discovered a clear skew on Swiss stocks, followed by Denmark. Firms listed on exchanges in those two countries are generally known for quality, therefore this phenomenon presents less of a surprise.

The following table shows all the stocks included in our portfolio together with the respective sectors, MOATs and countries.Portfolio Overview

Portfolio Performance and Back-testing

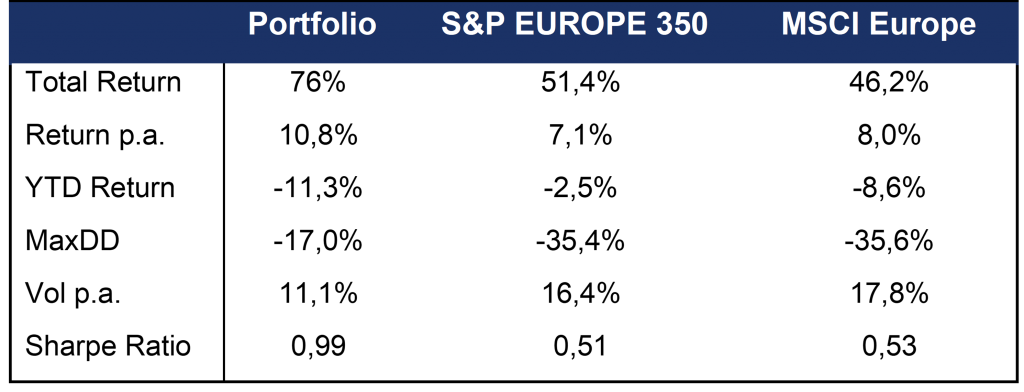

The created portfolio is back-tested from January 2017 until June 2022 and has seen a total return of 76%, based on dividend-adjusted share prices and an annual rebalancing of the portfolio. In the selected time period, it has outperformed the selected benchmark indices, namely the S&P Europe 350 with a total return of 51.4% and the MSCI Europe with 46.2%. The superior performance is also reflected in the Sharpe Ratio of 0.99 versus 0.51 and 0.53 respectively, combined with a lower annualized volatility of 11.1% compared to 16.4% and 17.8%. In fact, the portfolio was considerably more stable in the Covid-19 outbreak in March 2020 compared to the selected benchmarks.

Beyond that, similarly to most actively managed portfolios, it was rebalanced to equal weights every year in order to limit the exposure to particular stocks which would have a stronger weight in the portfolio due to better performance in the short term. This reflects our selection approach and the diversity of industries within our simulated portfolio. We therefore avoid being overly dependent on single stock movements.Backtesting Results

Macroeconomic Analysis

Yields and Inflation

The era of cheap money is ending. Interest rates are increasing, and QE programs are discontinuing. Bond yields have increased, and equity prices deteriorated. However, we believe that value stocks provide strong earnings stability that will drive returns even under the current challenging market conditions.

The increase in rates and consequently yields means that the cost of capital of companies will increase as well. In our portfolio criteria, we only include stocks that have a net debt/EBITDA ratio below 2.5x and total liabilities / total assets less than 70%, therefore our portfolio is more resilient to rate hikes.

Inflation levels surpassed expectations while the labor market is still strong. Aggressive rate hikes and decreasing central bank liquidity provisions will lead to tighter financial conditions while the main question is: how much tightening is enough to get inflation levels back to the target levels without severely damaging the economy?Sector returns MSCI Europe

We believe that the healthcare sector will benefit from changes in demographics, drug development and the history of relative price stability in volatile environments. Companies have experienced during the pandemic that supply chain issues could lead to catastrophic outcomes, therefore the process of moving manufacturing onshore could support information technology, materials and industrial companies due to heavy automation and inputs needed for the transition. Consumer discretionary is sensitive to the business cycle but some industries like luxury and companies that sell products with established brand names or products where switching-costs are high will likely continue to provide returns.

Investors are facing increased recession risk, but this means that the downside potential is at least somewhat reflected in current stock prices. In our view, companies that show solid fundamentals are not at risk currently, therefore lower valuation levels might open opportunities for value investors. As Nathan Rothschild famously said: “Buy when there’s Blood in the Streets”.Conclusion

The proposed strategy may be implemented by retail as well as institutional investors. Retail investors could easily filter stocks using one of the freely available online tools and follow the qualitative criteria described in the article with relatively little effort. For institutional investors there is sufficient liquidity to invest with and active management elements could be added to enhance results or to tailor the portfolio to the needs of their clients.

Active management might include continuous screening or risk management. Furthermore, more rigorous qualitative assessment may be beneficial in certain industries and relaxing of fundamental standards in others, depending on the features of the specific industry.

In the end, regardless of how good the performance of the companies in our portfolio are, the main market trends will have a significant effect on their performance. Shipping and labor costs, environmental regulation, inflation and supply chain problems could disrupt revenues even if consumer demand stays high. However, value stocks could yield the best risk-return tradeoff during volatile market conditions, which makes them a perfect fit for present times.Disclaimer The information set forth herein has been obtained or derived from sources generally available to the public and believed by the authors to be reliable, but the authors do not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. This report should not be considered to be a recommendation by any individual affiliated with WUTIS – Trading and Investment Society e.V.